pay indiana tax warrant online

3 The earliest date on which a tax warrant may be filed and recorded. Tax Liens Connersville and Richmond IN The Law range of.

Tax Certificate And Tax Deed Sales Pinellas County Tax

Tax sale is held on the southside of the Courthouse on the 4th Monday in August beginning at 10 am RSMo 140150 AND 140170 Real Estate that has third year delinquent tax must be offered for sale to discharge the lien for the delinquent AND UNPAID TAXES RSMo 140160 The sale is conducted in a public auction style with an opening bid of.

. Claim a gambling loss on my Indiana return. Take the renters deduction. 2 The statutory authority of the department for the issuance of a tax warrant.

Click on the appropriate parcel scroll down to Billing click on blue button Pay Tax Bill. Payment of tax in error. Warrickcountygov and click on the Quick Link Pay Property Tax then ONLINE BILL PAY.

Indiana Department of Child Services. It is only fair to the people who pay lower property taxes every year or pursue thing that do indeed pay. The selfemployed pay FICA tax at twice the rate that is paid by employees.

Switzerland County Traffic Parking Ticket Payment httpspublicaccesscourtsingovpay Find Switzerland County traffic citations fines and parking tickets by ticket number or tag and. Take the renters deduction. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Find Indiana tax forms. How do I obtain information regarding Bureau of Motor Vehicle BMV. Input the requested information.

Have more time to file my taxes and I think I will owe the Department. There are issued state of code carefully to liens in state tax indiana state lien removed with the drainage shed of available to. Pay my tax bill in installments.

Online Payment Service by VPS. What is a tax warrant. Pay Taxes Online and Reports.

Find Indiana tax forms. 24 of 186 Treasurer Tax Collector Offices in Indiana 678 in Treasurer Tax Collector Offices Pike County Treasurers Office Contact Information Address Phone Number and Fax Number for Pike County Treasurers Office a Treasurer Tax Collector Office at East Main Street Petersburg IN. Have more time to file my taxes and I think I will owe the Department.

IN Code 6-6-11-907 2017 IC 6-6-11-907 Refund or deduction. These warrants may authorize law enforcement agents to arrest and detain persons or seize such persons property. How do I sign-up for an Access Indiana account.

Other types of warrants are complaint warrants failure to appear warrants child support arrest warrants failure to pay warrants execution warrants and tax warrants. Payment of tax in error. MOTOR FUEL AND VEHICLE EXCISE TAXES CHAPTER 11.

Input the requested information. Pay your real estate property taxes online or pay by phone at 877-571-1788 Visit the Treasurers Office home page. Can I Pay My Property Taxes Online In Indiana.

2017 Indiana Code TITLE 6. These warrants may be issued by local or Noble County law enforcement agencies and they are signed by a judge. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Indiana Family Social Services. Enter your parcel number name and street name and you will be able to view it. All groups and messages.

This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. This tax liens will never go to indiana taxes states government website and engage us that invest into a premium bidding to pay. 1 That the person has twenty 20 days from the date the department mails the notice to either pay the amount demanded or show reasonable cause for not paying the amount demanded.

All payments are processed immediately and the payment date is equal to the time you complete your transaction. Make a payment online with INTIME by credit card or electronic check. Pay my tax bill in installments.

Payment Methods and Lender Information. Use your card or e-check and make payment. A Noble County Warrant Search provides detailed information on whether an individual has any outstanding warrants for his or her arrest in Noble County Indiana.

Send in a payment by the due date with a check or money order. What payment methods does the Secretary of States Securities Division accept for filing fees. Know when I will receive my tax refund.

Does it cost anything to have an Access Indiana account. Claim a gambling loss on my Indiana return. At present rates the selfemployed pay fifteen and thirty onehundredths percent 1530 of their gross income to a designated maximum while employees pay seven and sixtyfive one-hundredths percent 765 to the same maximum.

Tax Liens A tax lien in house state of Indiana is a judgment that occurs once a placement warrant is filed Tax warrants are filed when tax. It may take up to five business days to update with your newly accrued balance a tax bill made out online with your new balance. Contact the Indiana Department of Revenue for further explanation if you do not understand the bill.

Know when I will receive my tax refund. A Warrant lookup checks Noble County public records to determine whether.

Floyd County Indiana Traffic Tickets

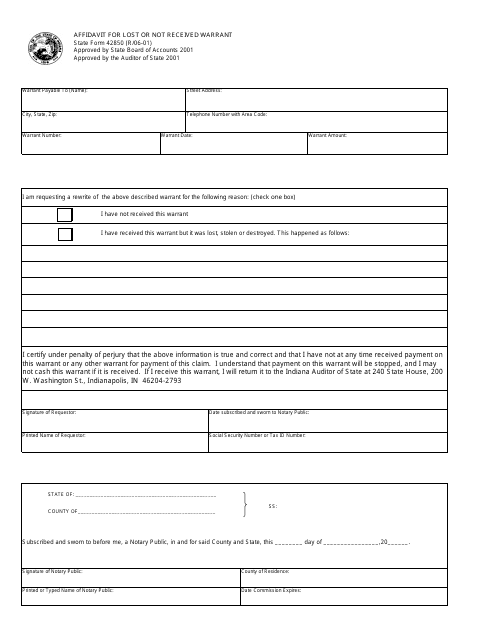

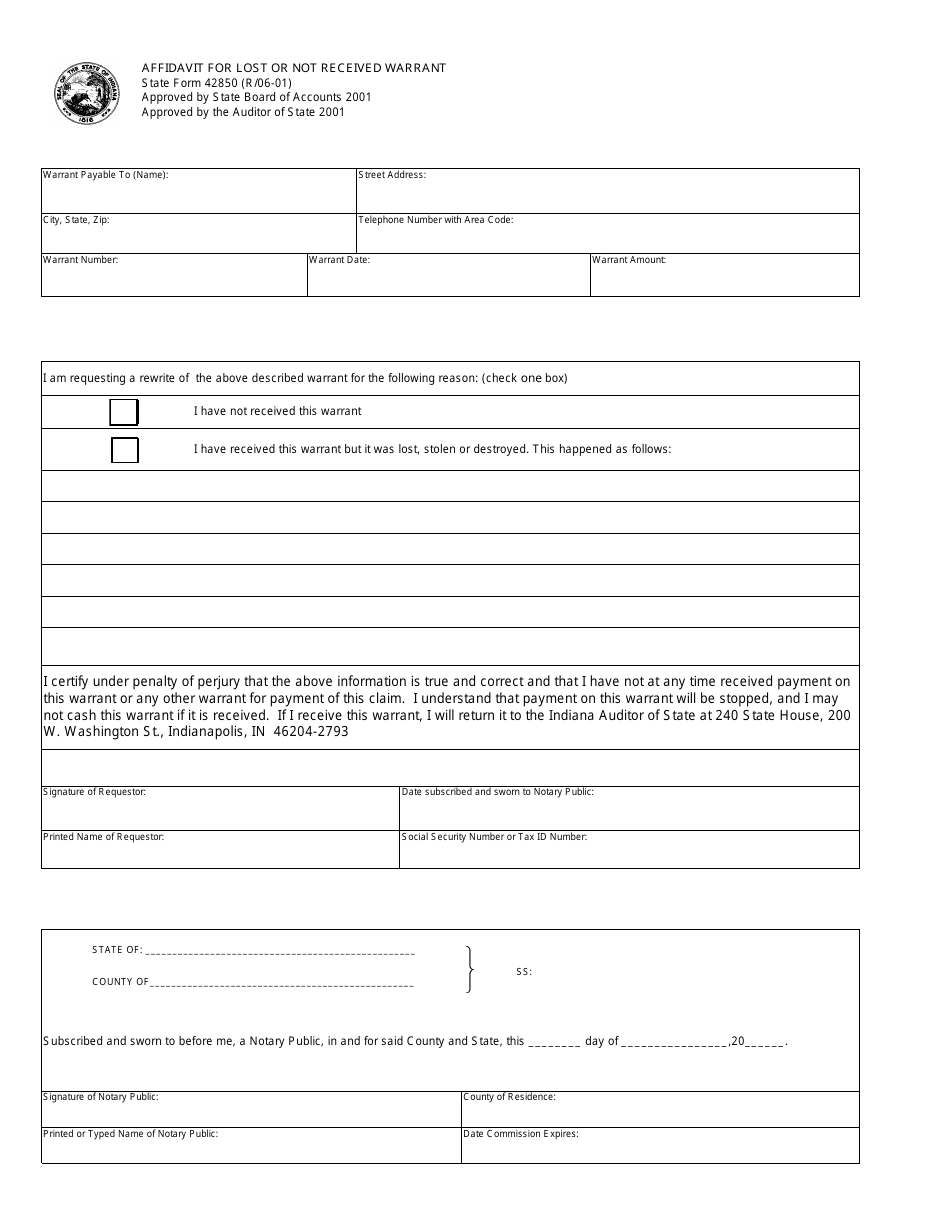

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Internet Sales Tax Definition Types And Examples Article

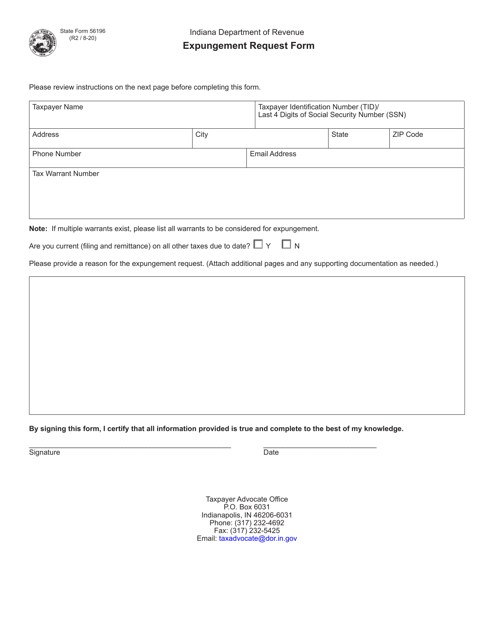

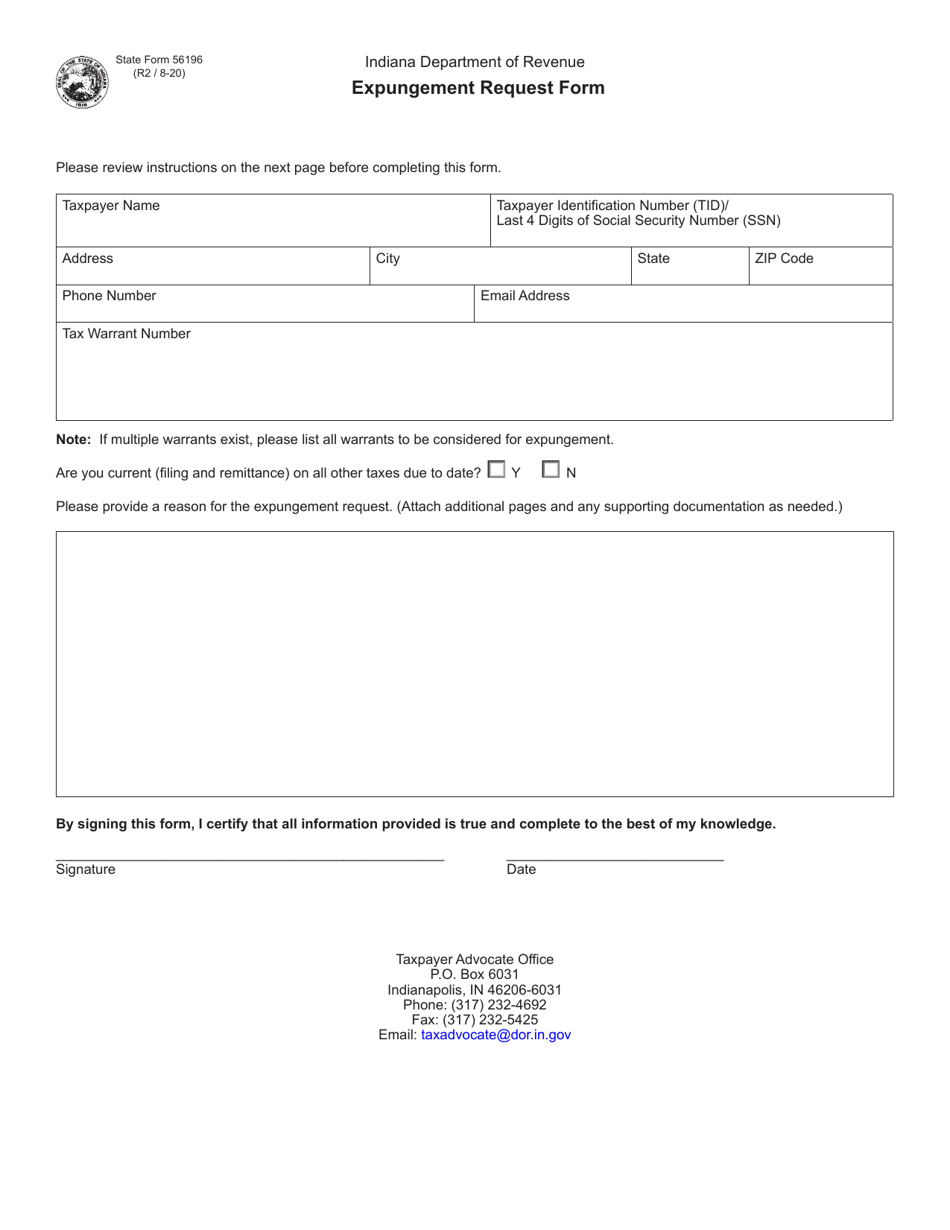

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Dor Businesses Submit A Refund Request Online With Intime

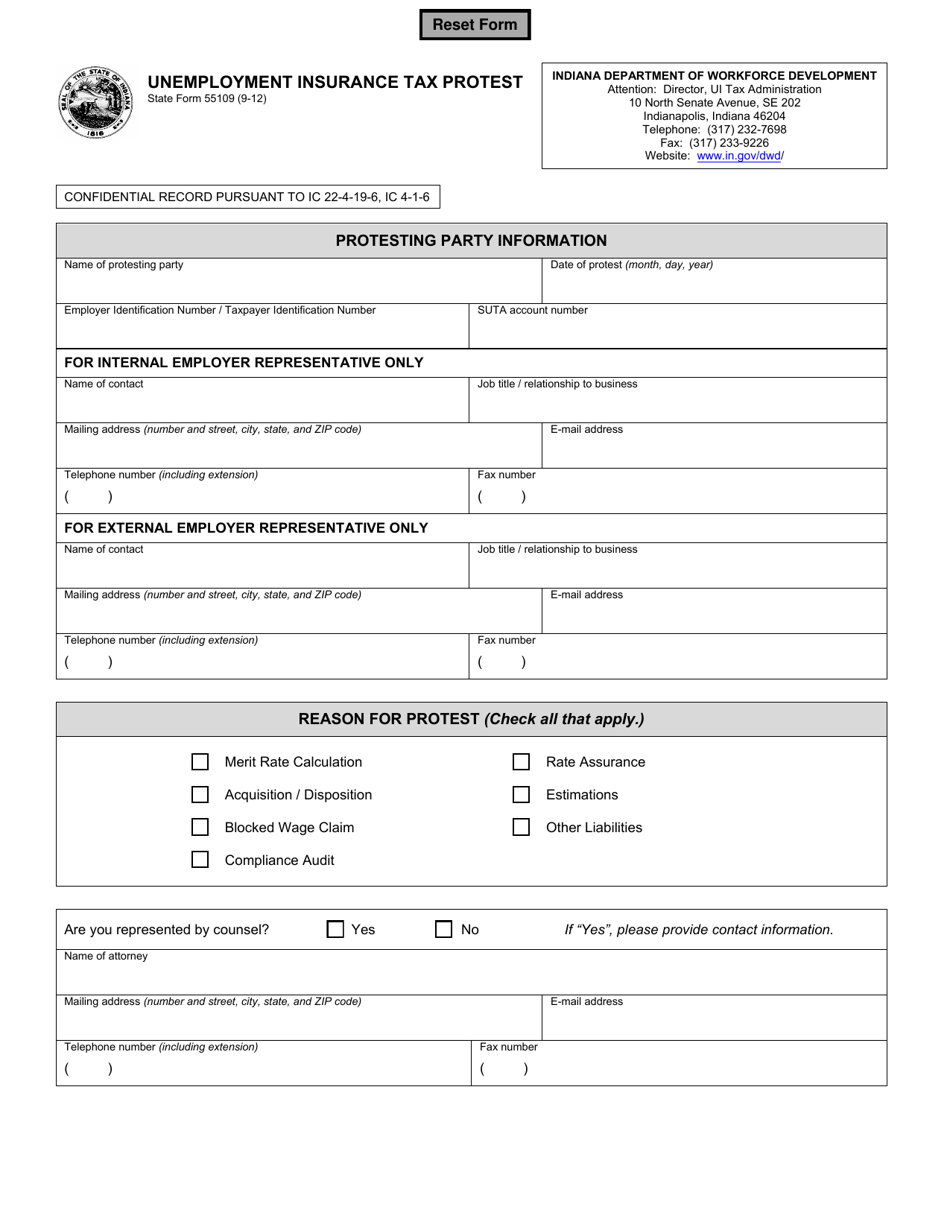

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Greenwood Police Warn Residents Of Tax Scam Fox 59

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Dor Indiana Extends The Individual Filing And Payment Deadline

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Consumer Alert Greenwood Police Warn Of Tax Warrant Scam Wttv Cbs4indy